Easy Credit

₦1,000 to ₦5,000

15% per month with minimum of ₦500 interest

Tenor

3 - 15 days

Processing Fee

₦400

*Build your credit history with Irorun

Whether you need N50,000 tomorrow or an urgent N2,000, Irorun is one of the top loan apps in Nigeria, helping you borrow money online easily, and with low interest.

At Irorun, we understand your needs and, as you continue to repay your loans, we reward loyal customers with higher loan limits up to ₦50,000, low interest rates, and exciting perks like birthday gifts and bonuses for referring friends to borrow easily and meet their financial needs with us.

We reward our loyal customers with special perks, including interest-free loans for a limited time, so you can meet urgent needs without worrying about high interest rates.

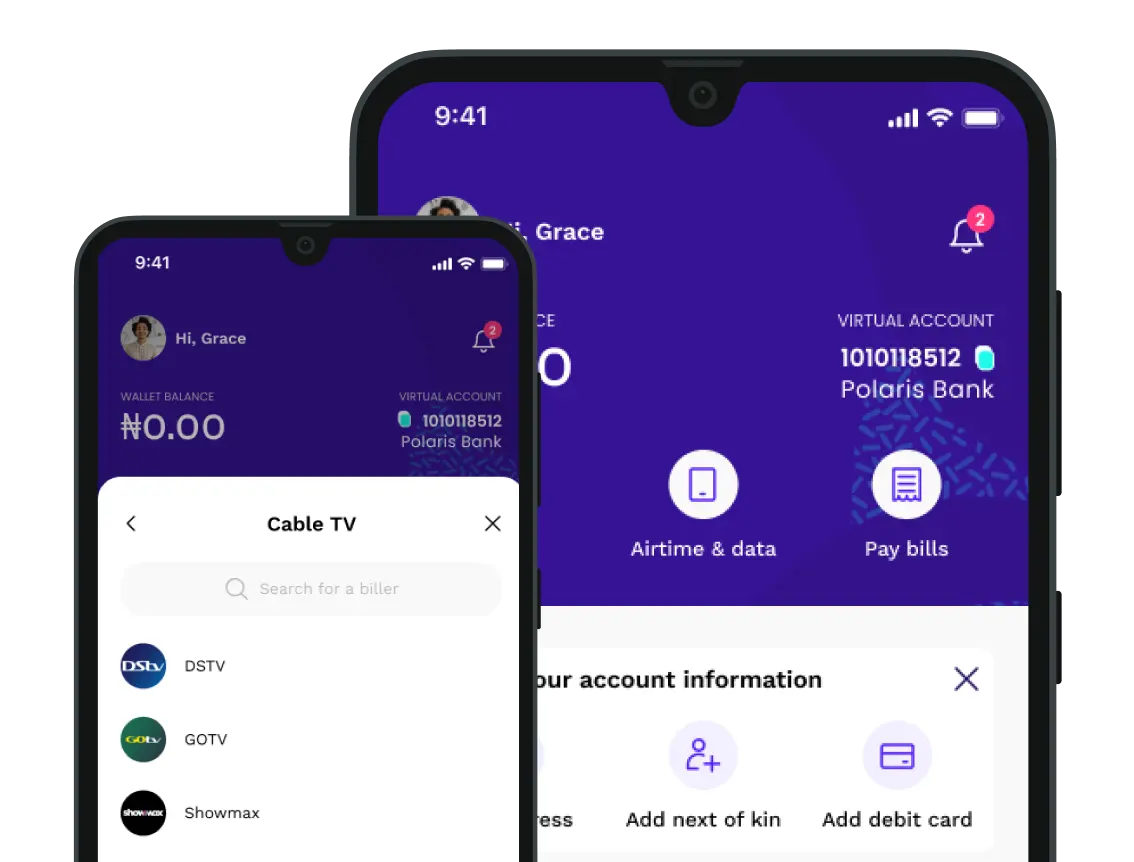

With only a few clicks on your smartphone, you can pay all of your bills and top up your airtime at the lowest possible cost.

Ethical behavior (no harassments)

We will never misuse your data, resort to shady debt collectors, or harass your friends and family. If you are having issues with your repayment just reach out to us. We are always here to help.

Getting a loan with Irorun is as easy as ABC if you take the following simple steps:

As a general note

If your loan got declined, it may be one of these reasons. If you think this was wrongly done, you can engage with the Customer Support team right on this chat.

Our loan decision process usually takes about 24 hours [or longer during weekends] before updating your loan status.

If your loan status has been pending for more than 24 [or 72 hours] hours please reach out to us on the app or at support@irorun.com to look into it.

Kindly exercise patience as we review your loan application.

On Irorun you are only allowed to have one active loan at a time. If you would like to get another loan you must repay your current loan first. Applying for another loan immediately after you've just repaid your loan might cause the system to find you ineligible as our system can take up to 24 hours to process and resolve your repayment.

If after 24 hours you are still ineligible for a loan please reach out to us on the app or at support@irorun.com to look into it.

For you to have access to higher loan amounts you must show evidence that you will be able to repay the loan by applying for a lower loan amount and repaying it. For example if you pay back your first two loans, you would be able to get ₦10,000 with a longer time to pay back.

And it doesn't take that long to have us trust you with even much more. If you need further assistance, please email support@irorun.com. If after 24 hours you are still ineligible for a loan please reach out to us on the app or at to look into it.

Here are the 5 most common reasons for why loans get declined;

Get instant loans with ease on your smartphone.